FINANCE 102 for Kids

In Finance 102 for Kids, children and parents will learn:

How to spend wisely and live within your means

How to determine the real cost of a purchase and make informed decisions

Different ways to stretch your money’s worth

How to resist unhealthy media and social influence

How to make credit cards work for you

The power of saving, investing, and compound interest

How to protect your money, property, and reputation

Things beyond money that can make you rich

Excerpts

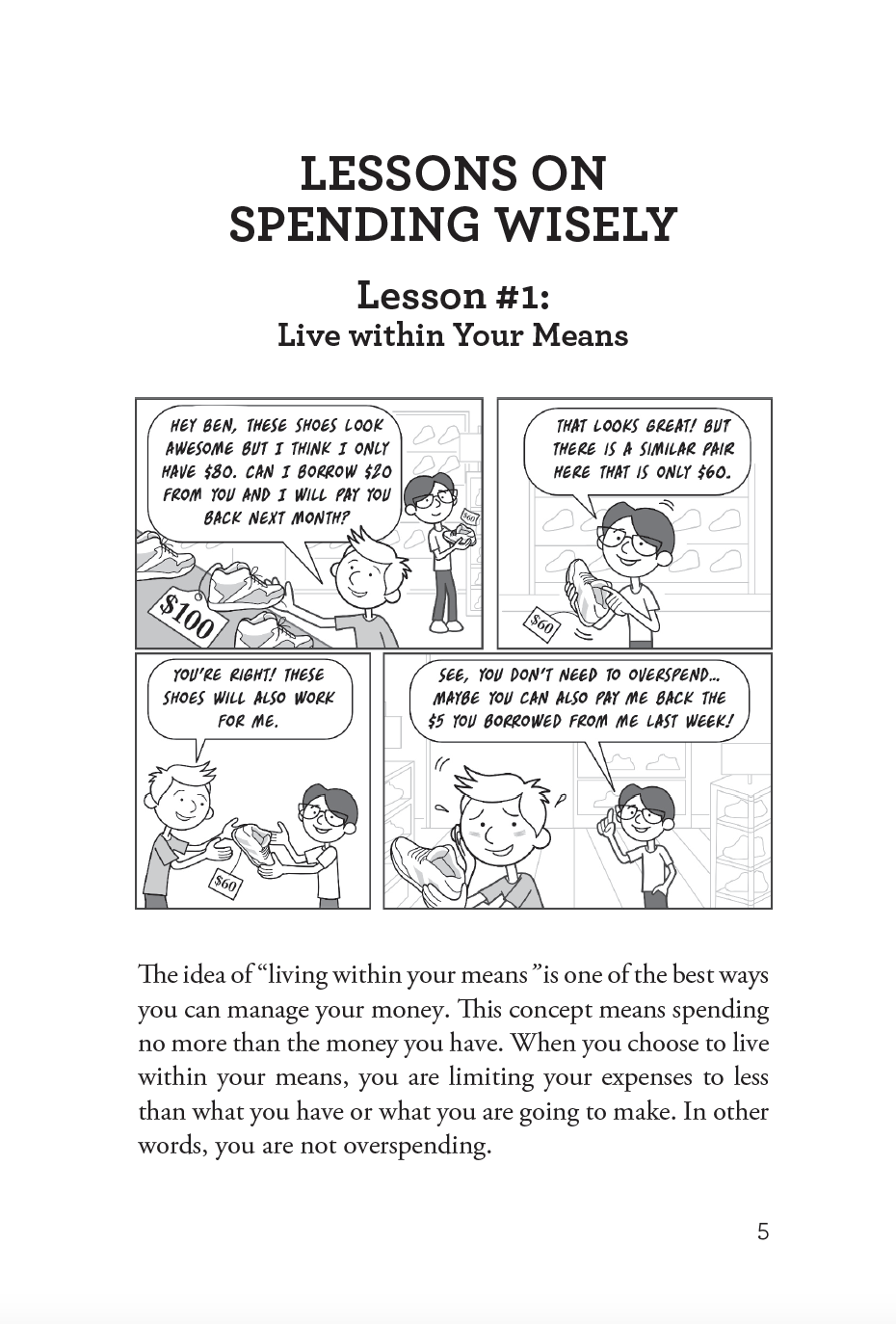

Lesson #1: Live within Your Means

The idea of “living within your means” is one of the best ways you can manage your money. This concept means spending no more than the money you have. When you choose to live within your means, you are limiting your expenses to less than what you have or what you are going to make. In other words, you are not overspending.

Lesson #23: Put Time on Your Side

Kids like you are in a great position to greatly benefit from the power of compounding interest because you have more time than adults to make your money grow. The sooner you start saving and investing, the higher the reward you will reap. When you start to save and invest early, you are giving your money more time to grow. The power of compounding can help your money earn more when you give it more time to grow.